In This Article

I’ve been a happy Zoho One user for more than 5 years. While I’ve moved marketing, meetings, calendars, and more – my accounting software has been stuck with QuickBooks And, I’ve hated every minute of it.

Each month, I give QuickBooks $80. Think about that. I’ve been paying twice the amount for one app (Zoho One is about $40/month) as I do for an entire suite of integrated tools that run my whole business. And now that Zoho has launched its U.S. edition of Zoho Payroll, the timing couldn’t be better.

The Problem with Running a Business on Too Many Tools

If you’re running a small business, you’ve probably felt this pain. You’ve got QuickBooks for financials, Trello for projects, some kind of CRM, a payroll tool that barely talks to anything else, and maybe a dozen spreadsheets in between. That’s a lot of toggling back and forth, a lot of manual data entry, and a lot of lost time.

Nothing integrates as smoothly as it should, and you’re constantly second-guessing your numbers. Sound familiar? That’s where Zoho One comes in. It’s not just one tool—it’s an entire ecosystem where everything works together.

Zoho One – The Operating System for Small Business

Imagine a world where all your business tools play nicely together (cue angelic choir). Whether it’s handling your finances, projects, or marketing, Zoho One keeps everything seamless and oh-so-simple. Plus, the price? A fraction of what you’d pay for piecing together different apps. Talk about a BARGAIN!

If you’re ready to take the leap from surviving to thriving, Zoho One is your trusty steed. Let’s ride into the sunset of efficiency, my friends. Click that button and get ready to supercharge your hustle!

And now with Zoho Payroll, I’ve finally got a complete, integrated financial system for my business.

Let me walk you through the details, and I’ll show you exactly why I’m so excited.

The Dashboard That Does It All

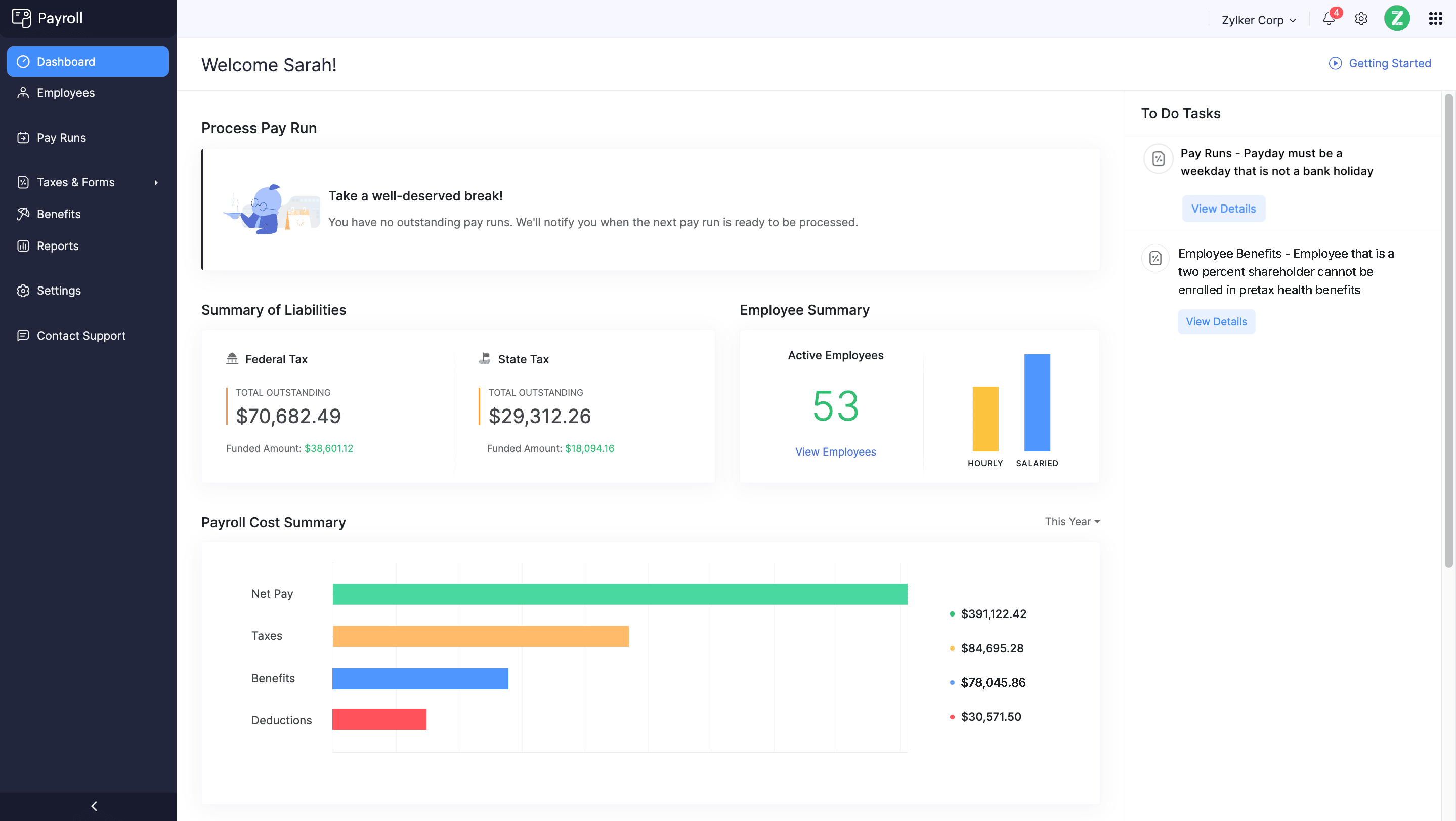

Let’s start with the Zoho Payroll Dashboard, where everything you need is right at your fingertips. This isn’t one of those cluttered dashboards that gives you 20 charts but no real answers. It’s simple, clean, and shows me exactly what I need to know:

- How much you owe for federal and state taxes

- Your total payroll costs, broken down into net pay, taxes, benefits, and deductions

- A quick snapshot of your active employees and whether they’re hourly or salaried

Look at that! Everything is right where it should be, without any of the clutter or confusion. No more jumping between systems or reconciling scattered data. It’s all in one place, ready to go.

Managing Employee Benefits Doesn’t Have to Be a Headache

No employees? No problem. I’m willing to bet that you’re avoiding offering comprehensive benefits because, let’s be honest, it’s a lot of work. Managing 401(k)s, tracking PTO, and keeping up with health insurance details isn’t exactly a small business owner’s dream task. But Zoho Payroll makes it easy to manage all of that in one spot.

This is what benefits management looks like when it’s done right. You can set up everything from retirement plans (401(k)s, Simple IRAs, you name it) to medical, dental, and vision insurance. It even tracks PTO balances and accruals automatically. That means I can offer a real benefits package to my team—full-timers, part-timers, even my virtual contractors—without the usual headache.

Taxes? Handled. Like, Really Handled

Let’s talk about taxes, everyone’s favorite topic. If you’ve ever missed a payroll tax deadline, you know how stressful it can be. The fines add up fast, and the paperwork is brutal.

Zoho Payroll automates the entire process for federal, state, and local taxes in all 50 states. That means it calculates, files, and pays everything for you, on time, every time.

I mean, look at this. It’s clean, clear, and straightforward. Everything’s tracked, and you can see exactly what’s pending and what’s funded. No more chasing down tax forms or panicking at the last minute.

Online Payroll System | Cloud Payroll Software | Zoho Payroll

Zoho Payroll is a seamless, all-in-one payroll solution for small businesses. It automates tax compliance across all 50 states, simplifies benefits management, and empowers employees with a mobile self-service portal. Fully integrated with Zoho Books, People, and Expense, it’s the perfect tool to streamline payroll and grow your business effortlessly.

Zoho Payroll vs QuickBooks Online

But wait! QuickBooks is the standard – is it worth the hassle of switching?

Honestly, that’s not for me to say. After all, it’s taken me a few years to get here. But as soon as the opportunity presented itself, I was in.

I get it. For years, QuickBooks Online has been the go-to for small business accounting and payroll, but the comparison starts to fall apart when you dig a little deeper. At least it has for me.

| Feature | Zoho Payroll | QuickBooks Online + Payroll |

| Monthly Cost | $90 (Zoho One – 55+ apps included) | $80 (accounting + payroll only) |

| Integration | Fully integrated with Zoho Books, CRM, and Zoho Expense | Limited integration with third-party apps |

| Tax Filing | Automated for federal, state, and local taxes across 50 states | Federal and state taxes; setup required for some compliance |

| Benefits Management | 401(k), IRA, health insurance, PTO tracking | Basic benefits with fewer built-in options |

| Employee Self-Service | Mobile app for pay stubs, tax updates, PTO tracking | Available, but less streamlined |

When you break it down, Zoho Payroll does everything QuickBooks Payroll does—and more—at a lower cost, with seamless integration across all your business operations. QuickBooks feels like a standalone tool with add-ons, while Zoho Payroll feels like part of a bigger, smarter system.

The Employee Experience: A Mobile App That Makes Life Easier

Here’s the part my team loves the most: the Zoho Payroll employee self-service portal. If you’ve ever had someone email you asking for a copy of their pay stub or wanting to know how much PTO they have left, you’re going to love this too.

This mobile app is a game-changer. Employees can view their pay stubs, update their tax withholdings, check their benefits, and even track PTO—all from their phones. It’s like giving them their very own payroll assistant. And you know what that means for me? Fewer emails, fewer interruptions, and a happier team.

Expense Reimbursements Made Simple

If you’ve got a virtual team like I do, chances are you deal with a lot of expense reimbursements. Zoho Payroll integrates seamlessly with Zoho Expense, which means approved reimbursements flow straight into payroll. No more tracking down receipts or manually adding reimbursements to paychecks.

It’s smooth, seamless, and automatic. Exactly how it should be.

W-4 Forms? Paperwork-Free

Onboarding a new team member? Zoho Payroll even handles digital W-4 forms. Employees can complete, verify, and submit their forms right from the platform. No more scanning, printing, or chasing down paperwork.

It’s one of those small touches that makes a big difference when you’re running a small business.

Why This Matters for Your Business

Here’s the bottom line: if you’re juggling multiple software tools to manage your business, you’re working harder than you need to. I’ve spent years trying to make disconnected tools work together, and I can tell you firsthand—it’s not worth it. With Zoho One, everything from payroll to marketing to project management happens in one place. And now with Zoho Payroll, I finally have a financial system that’s fully integrated and built to grow with my business.

This isn’t just about saving money (although the savings are real). It’s about saving time, reducing stress, and making better business decisions because all your data is finally working together.

For $90 a month, I’m running my entire business on Zoho One. That’s CRM, email marketing, project management, and now payroll—all for the same price I was paying for QuickBooks alone.

If you’re still juggling a dozen tools or hesitating to hire because payroll feels too complicated, let this be your sign: it doesn’t have to be. Zoho Payroll is here, and it’s everything small business owners like us have been waiting for.

2025 is my year of integration. What about you?