In This Article

Use this market research process every time you have a business decision to make

Market research is often the nerd of the marketing playground. It’s not popular, it’s not sexy, and it doesn’t sing and dance on TikTok.

But like all nerds, market research has the very thing you need to make and keep your business successful.

If you were to search around the most recent data about why small businesses fail, you’ll find a handful of answers that rise to the top; lack of cashflow or capital (duh), not meeting a need (hence, no cashflow), and lack of market research (not understanding what people want).

I’ll bet that you think that this means that businesses fail because they didn’t do surveys..or they didn’t pay some consultant or agency thousands of dollars.

Nope.

It’s so much simpler than that:

- Businesses fail when they don’t make enough money.

- To make money, you need to sell stuff.

- To sell stuff, you need customers.

- To get customers, you need sell something they want and are willing to pay for.

Market research is how you make sure that:

- You’re in an industry that wants what you’re selling.

- The market or target customer you want to buy your stuff wants to buy your stuff

- That the stuff you’re selling is priced accordingly

- That you’re selling your product through the best channels

When you look at it this way, market research becomes infinitely more practical. And, the good news for you is that it doesn’t have to be complicated or expensive.

What is Market Research — A practical definition

Market research is a process of collecting data and information that helps you make decisions about your business and measure the results of your marketing activities.

Market research is part of the marketing process

Most entrepreneurs don’t even realize that marketing is actually a PROCESS — sort of like doing a long-division problem.

Most of us can’t solve a complex long division problem without showing our work. The same is true with the marketing process and market research!

You have to see the process so that you can follow the process.

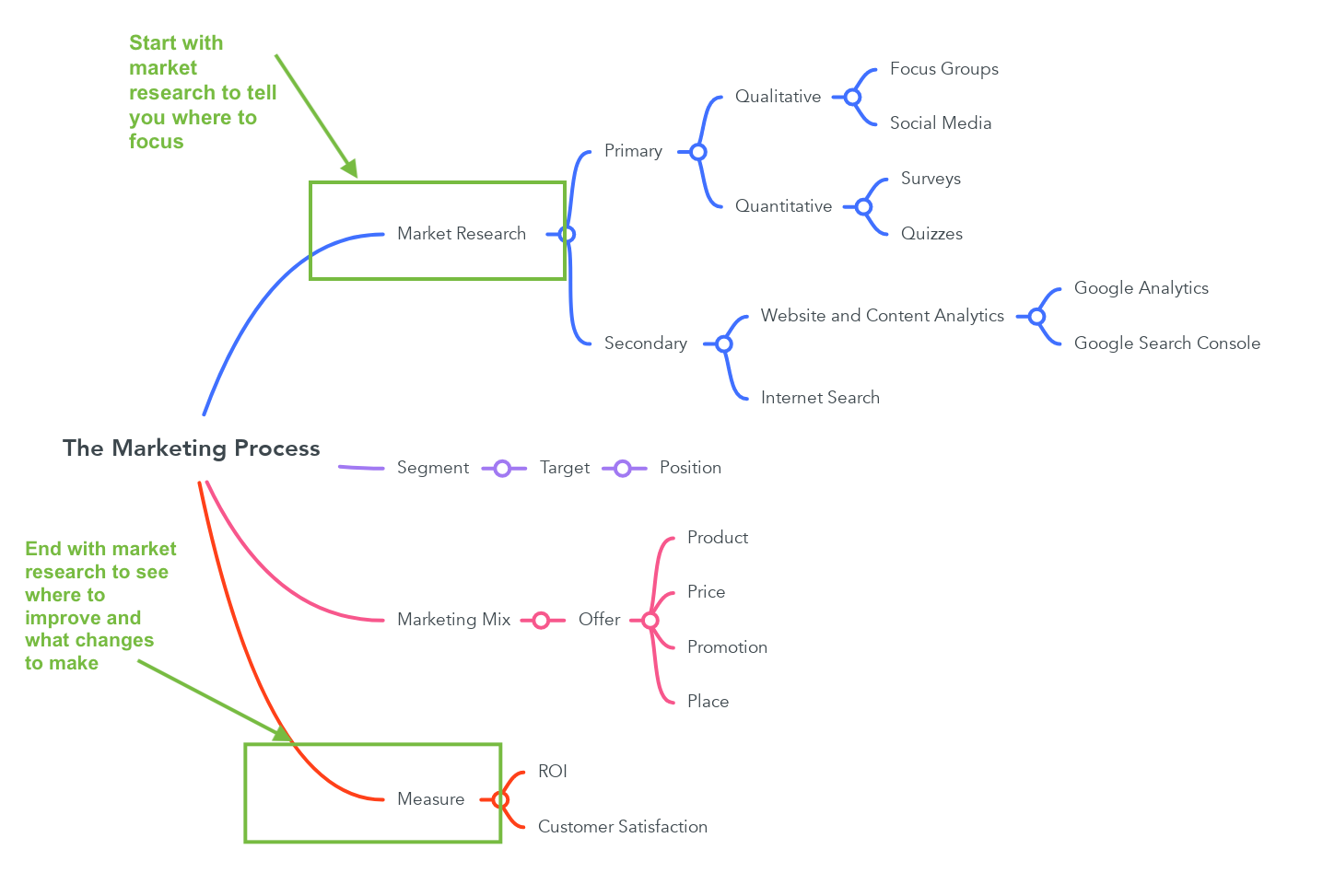

Here’s an illustration of what the marketing research process looks like.

See how market research activities are at the beginning and at the end of the marketing process?

In other words, you do market research to figure out what your

Makes sense — right?!

A Quick Primer on the 4 Basic Types of Market Research Process Elements

There are two categories of research:

- How you’re going to collect the information (Primary or Secondary)

- What type of information you’re collecting (Qualitative or Quantitative)

Primary vs Secondary Research

This is the category of “where your information is coming from) is it coming from your engaging with people or is it coming from OTHER people.

Primary research is when you collect data firsthand from survey respondents, customers, or participants. This can be done in person, over the phone, or online.

Types of primary research include:

-Surveys

-Focus groups

-Interviews

-Ethnography

Here’s some more good news. You don’t have to take this literally, in my opinion, social media conversations that are categorized as “user generated content” are about as close to voice of the customer that you can get.

So, if you were to join Facebook groups where your ideal customers hang out and search for words like “challenges” or “frustrated”, you’re going to get a ton of what I would classify as primary research.

Secondary research is the collection and analysis of information that has already been published. This can include data from studies, articles, reports, whitepapers, and more. In other words, when you search on Google, you’re doing secondary research.

Qualitative vs Quantitative Research

This category is about the form your information takes. Is it qualitative or soft data like stories, interviews, collections of conversations. Or is it quantitative or hard data like percentages and numbers that you’ve gathered from surveys and studies.

Qualitative and quantitative information can come from primary research such as interviews and conversations that you’ve had) or secondary sources such as studies that you’ve found online.

How to use qualitative research?

Qualitative research is ideal when you’re exploring your market. It doesn’t necessarily involve numbers or data. It might include structured conversations that you have with potential customers.

Let’s say you eventually wanted to do a survey, but you weren’t sure what questions to include or what choices to include for your survey. You’d do some qualitative research.

Qualitative research would include the following:

- Conversations with potential customers where you might ask about how they are solving their problems. You might even ask to observe how they do something.

How to use quantitative research

Quantitative research methods are used to collect data that can be measured. Typically, you’d take what you learned from your qualitative research and create a survey that would translate that warm and fuzzy information into data that is structured and statistical.

For example. if qualitative data told me that there were 3 reasons businesses failed; lack of cashflow, not understanding the customer, and not having the right product, I would send a survey to people who closed their businesses and ask them “Which of these is the primary reason your business failed?” The results would be hard numbers such as 55% of surveyed businesses closed because they didn’t have enough cash flow.

Quantitative research can be as simple as a survey and as complex as trade-off analysis. Remember, quantitative just means that it’s got hard numbers attached. It doesn’t have to be hard, it doesn’t have to be expensive.

A Simple Market Research Plan Template

You’ll want to save this because it’s the logical step-by-step market research plan I use every time I have a business decision to make.

Step 1: Make a list of decisions that require data and information

The standard first step is to “set goals”, but to an entrepreneur, this is too fluffy. It’s much easier to think about what decisions you have to make.

Sit down and think about what information do you need in order to move forward and what does moving for ward look like.

Start with these:

- Is there a demand? Are there enough people in this market to sell to?

- What are the characteristics of my ideal customer?

- What does the offer look like?

- How much do I need to charge?

- Where should I promote this?

- What words do my ideal customers use to talk about this?

- What is my target market’s ideal outcome? What does success look like for them?

Open up a document and put these questions in there. If there are other questions that are nagging at you, add them to this document.

At this stage of the process, you want to stay completely “open” and your goal in the next step is to simply collect information to get a lay-of-the-land.

Step 2: Collect Secondary Research – Searching Online

With your open document and your questions in front of you, it’s time to hit the internet and start searching.

Stay focused on your decisions and your questions. I’ve outlined some of them here.

Is there a market for what I’m selling? Are people buying these types of products and services?

This is the first, and most important bit of information. If there is no demand for what you’re selling, then there are no customers who want to give you money.

This means that you want competition. You want to be in a market where there’s a lot of conversation, a lot of products and services, and a lot of demand.

Don’t freak out if you see a lot of competition — that’s a good thing. Look at it this way. If you like reading mystery books, you’re not just going to buy ONE mystery book – right? Or, if you like shoes, you’re not just going to have one pair of shoes.

How to check for demand and make sure that you’re in a profitable market niche

1. Check Google Trends

You want to see a nice, solid, search demand on Google Trends. See how “koi pond installation” has a low demand while general “koi pond” has a lot of search volume.

2. Do a Google search for your product or service

When you see search results like this — that have a TON of ads and products, you’ve got yourself a winner. This tells you that people are interested in the “koi pond” conversation and they are spending money on installing and managing koi and their koi pond.

3. Look for Facebook groups and forums

Another place to check for demand is Facebook groups and forums. As before, if you’re not finding a lot of conversations about your topic, there’s not much of a demand. So keep looking.

Who is most likely to buy what I’m selling and pay me enough money so that I’m profitable?

Now that we know that there’s a market, we want to know who our ideal customer is.

Find your ideal customer (target market)

Even if you already know what you’re selling, set that aside for now. Your first step will ALWAYS be to identify a target customer.

Here’s my favorite way to do that. Imagine that you only got paid after your customer got the results that you promised, who is the person you can get the best results for, in the fastest amount of time and with the least resistance? Another way to look at that is to ask yourself:

- Who is TERRIBLE at what you do well?

- Who hates doing what you love doing?

- Who values what you do because they hate doing it, don’t like doing it, or don’t want to do it?

Who or what am I competing with? What objections should I address in my marketing?

The next decision you’ll want to make is how to position yourself in a way that will get your ideal customer to choose you.

This means that you want to know how they are currently solving their problem and what’s MISSING from the way they are currently solving their problem.

Who are my competitors?

- What alternatives are they using?

- How are they doing it themselves?

- What other companies, products, or services are they trying to get this result?

Step 3: Use your secondary research to create your survey or poll questions

With your document that contains all your secondary research, you’re now ready to start creating some questions and multiple choice options for your surveys and polls. These surveys and polls are going to generate quantitative data that will help you make your go/no-go or how to go decisions.

What you want to know from these surveys

- Customer challenges: what are the top challenges that your customers have

- What’s important to your customers: what outcomes are they looking for

- Current solutions: how are your customers currently solving their problem

- Performance of current solution: how do people rate their current solutions

- What’s missing in their current solution

- What price would you be willing to pay

- If this offer were available at X price, how likely are you to purchase it

Step 4: Come up with your decision criteria

We now take a break from information gathering to synthesize what we’ve learned from our qualitative research experience.

Think about what you’ve learned so far and come up with some decision criteria.

For example:

- If more than 70% of people are at least somewhat likely to purchase, I will continue

- If 50% of the people are at least somewhat dissatisfied with their current solution, I will keep going.

This is a critical step to the process because then you won’t get wrapped up in “nice to know” information and focus on the data as a decision-making tool.

If your results come back “negative” — meaning that it doesn’t look like a good idea to move forward, see if you want to make changes and relaunch the survey.

Step 5: Figure out how and where this data is going to come from

You can use a variety of tools and ways to get this quantitative information. You can use surveys, polls, and quizzes. It’s up to you.

Here are my recommendations:

- Surveys: You can collect all this information at once using a survey. Make sure that your survey is NO LONGER than 10 total questions. In addition to my recommended questions, be sure to add demographic questions such as age, education, gender, geography, employment status, and any other attributes you want to measure.

- Polls: Polls are usually one and only one question. I recommend that you use polls as a follow-up to your survey responses back to gather more colorful information from a specific audience.

- Quizzes: This takes all the elements of a survey but ends the experience with a recommendation from you. This is a great choice if you have recommendations based on specific outcomes and it’s also a great lead generation tool.

Aim to get at least 100 responses to your surveys. I can’t say enough about this. You’re looking for data you can trust so that you can make a good decision. You can gather as few as 50, but you have to be 100% sure that everyone you are surveying is your target market.

Be sure to add an option to collect their information so that you can reach out to them and have a further conversation.

What Tools to Use to Gather Your Data

My favorite survey and polling tool: QuestionPro or SurveyMonkey

My Favorite quiz tool: TryInteract or Outgrow

Other Tool: Typeform

Step 6: Make sense out of the data

It’s time to analyze the data you’ve received. This is how I do it.

- Grab a screenshot of each question and paste it into a document

- Jot down every single thing that this data means to you. Why do you think one number is high and the other is low. Just do a brain dump.

- At the end of the process, what does all this mean to you? What will you do? What will you do differently? What would you change?

Make Research a Regular Part of Your Process

Using the market research process we’ve outlined in this article is an essential part of making sound business decisions. It’s a tried and true method that will help you gather accurate data so that you can make informed choices about your products, services, and